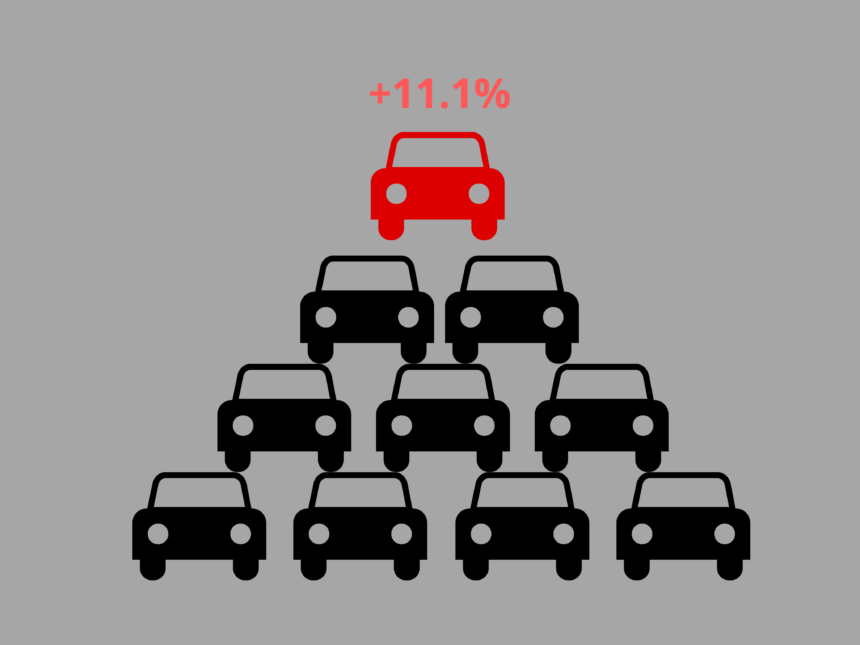

China’s auto industry kicked off 2024 with positive momentum, recording an 11.1% year-on-year increase in total vehicle sales to nearly 4.03 million units in the first two months, according to data from the China Association of Automobile Manufacturers (CAAM). This growth was mirrored in production, with auto output climbing 8.1% year-on-year to 3.92 million units during the same period.

Passenger cars led the charge, with both production and sales exceeding expectations. Output grew 7.9%, reaching 3.36 million units, while sales surged by 10.6%, totaling 3.45 million units (CAAM). This strong performance suggests continued consumer interest in personal vehicles.

The commercial vehicle sector also witnessed healthy growth. Production rose 9% year-on-year to 560,000 units, while sales jumped even higher, increasing 14.1% year-on-year to 575,000 units (CAAM). This indicates a potential rise in commercial activity and infrastructure development.

A bright spot in the data is the continued strong performance of the new energy vehicle (NEV) market. NEV output reached 1.25 million units, reflecting a significant 28.2% increase compared to the same period last year (CAAM). Sales mirrored this growth trend, with NEVs finding homes with customers at a rate 29.4% higher than the previous year, reaching 1.21 million units (CAAM). This continued consumer preference for electric and hybrid vehicles bodes well for China’s transition towards a more sustainable transportation sector.

However, the data also reveals a slight cause for concern. Auto sales in February dipped by 19.9% compared to February 2023, reaching approximately 1.58 million units (CAAM). This could be attributed to various seasonal factors or temporary disruptions in the market.

Overall, China’s auto market presents a mixed picture for the first two months of 2024. While the broader trends point towards continued growth and a shift towards electric vehicles, the February dip suggests the need for further observation to understand the underlying factors.