A new report by the Hurun Global Rich List 2024 reveals a significant increase in the number of billionaires worldwide. The list identifies a staggering 3,279 billionaires. This surge reflects a growing concentration of wealth at the very top. The Hurun Research Institute likely surveyed 2,435 companies to compile this data on billionaires, compared to the number surveyed in the previous year.

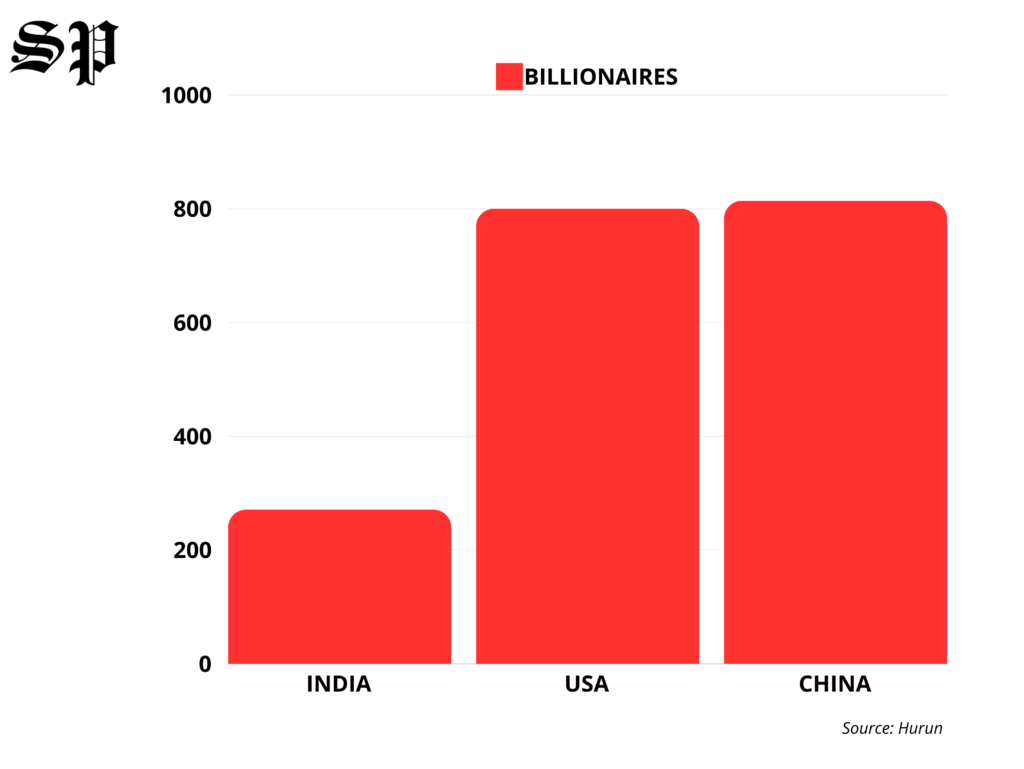

China maintains its position as the nation with the most billionaires, boasting an impressive 814 individuals. The United States follows closely behind with 800 billionaires, showcasing the continued dominance of these two economic powerhouses. India demonstrates significant growth as well, with 271 billionaires, solidifying its position as a major player in the global wealth landscape.

Beyond national trends, the report also sheds light on the cities attracting the most billionaires. New York City remains the global financial capital, with 119 billionaires calling it home. London comes in a close second with 97 billionaires, underlining its enduring status as a financial hub. Mumbai, India’s financial capital, makes a strong showing with 92 billionaires, followed by Beijing (91) and Shenzhen (84). Interestingly, the Greater Bay Area encompassing Guangdong, Hong Kong, and Macau boasts a combined total of 220 billionaires, highlighting the economic dynamism of this region.

China’s wealth isn’t solely concentrated in these megacities. The Yangtze River Delta region, known for its economic powerhouses like Shanghai, also boasts a significant concentration of wealth, with a reported 252 billionaires on the Hurun list. This underscores the nation’s diverse economic landscape and the presence of multiple hubs fostering immense wealth creation.

Shenzhen deserves a special mention as the city with the most self-made billionaires globally. This distinction underscores the city’s vibrant entrepreneurial ecosystem and its role in fostering wealth creation.

The Hurun report paints a picture of a world with a growing number of billionaires, with China and the US leading the pack. It also highlights the continued importance of established financial centers like New York and London, while acknowledging the rise of dynamic hubs like Mumbai, the Greater Bay Area, and the Yangtze River Delta region. As wealth continues to concentrate, the report raises questions about economic inequality and the need for more equitable distribution of resources.