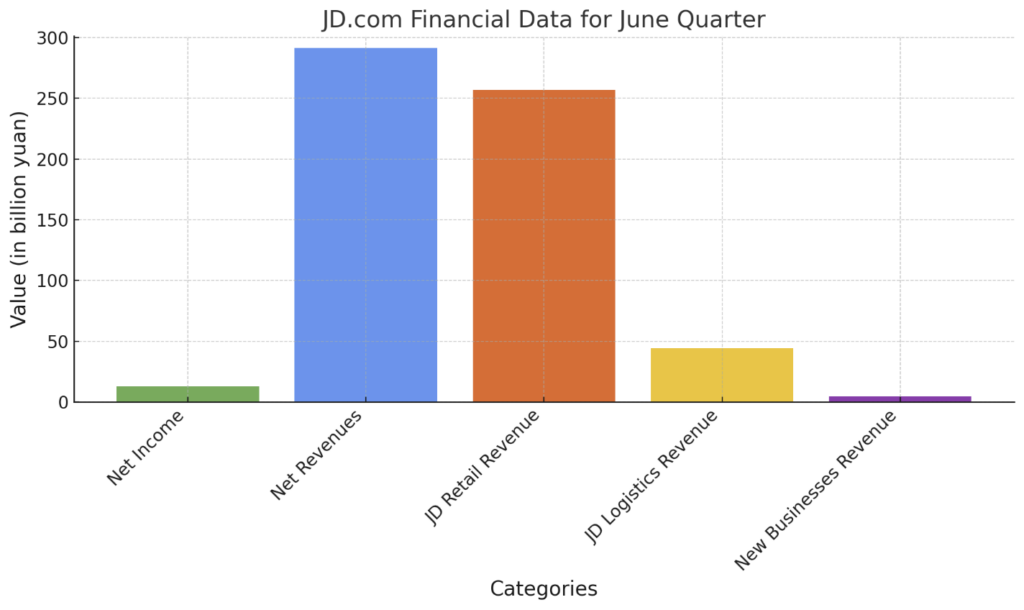

JD.com profit increase soared by 92% year-on-year in the quarter ending June 30, reaching 12.6 billion yuan (US$1.7 billion). Despite slight revenue growth, this profit surge was due to enhanced operational efficiencies. These efficiencies helped the company navigate the competitive domestic e-commerce landscape.

JD.com’s net revenues for the quarter rose by 1.2% to 291.4 billion yuan compared to the same period last year. Sandy Xu Ran, JD.com’s CEO, highlighted the company’s ability to achieve “growing economies of scale and procurement efficiencies,” allowing it to offer consumers low prices without compromising on quality.

Fierce Competition in E-Commerce

The e-commerce giant is currently embroiled in a fierce price war with major competitors, including budget retailer Pinduoduo and Alibaba Group Holding. These industry players have been engaging in aggressive price-cutting strategies to attract cost-conscious consumers in a sluggish economic environment.

JD Retail, which includes JD.com’s core e-commerce businesses, JD Health, and JD Industrials, reported a 1.5% revenue increase. Revenue for the June quarter reached 257 billion yuan.

JD.com profit increase was further bolstered by its success during the midyear 618 sales event in June. The company achieved record-breaking transaction volumes and orders, with 500 million customers participating in the promotion. Orders contributed over 1 billion yuan in sales across 83 brands, and more than 150,000 small and medium-sized merchants saw a 50% sales growth during the event.

Online Retail Thrives

While China’s overall retail sales growth slowed in June, online retail continued to thrive, growing nearly 10% in the first half of the year and reaching 7.1 trillion yuan. This growth was partially driven by a government-organized trade-in program aimed at boosting post-pandemic economic recovery. JD.com committed over 6.5 billion yuan to this initiative, primarily to subsidize consumers trading in home appliances and electronic goods.

JD Logistics, which handles both internal and external logistics operations, reported a 7.7% increase in revenue to 44.2 billion yuan. However, revenue from JD.com’s New Businesses group, including the on-demand delivery platform Dada, JD Property, and overseas ventures, declined by nearly 35% to 4.6 billion yuan.

Future Outlook

JD.com’s stock, listed in Hong Kong, fell 1.44% to HK$99.35 on Thursday ahead of the earnings announcement. Despite intensified competition and a tepid economic environment, JD.com remains committed to efficiency and strategic growth. This commitment positions the company to maintain a strong presence in China’s dynamic e-commerce market.