CK Hutchison Earnings Decline Amid Heightened Global Tensions

Billionaire Li Ka-shing’s flagship companies, CK Hutchison and CK Asset, have reported a weaker performance in the first half of the year, reflecting challenges amid heightened geopolitical and trade tensions. This CK Hutchison earnings decline is part of a broader trend affecting global markets.

Financial Performance Overview

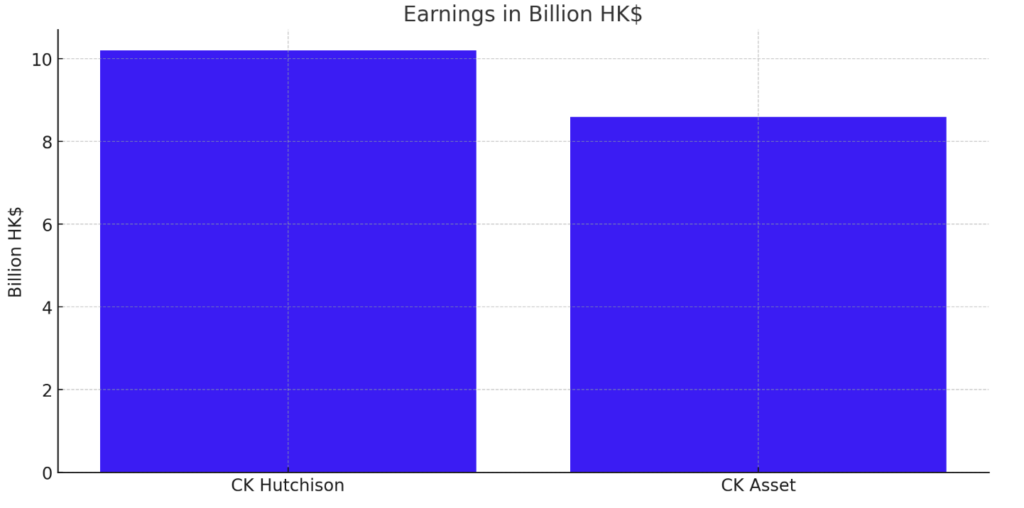

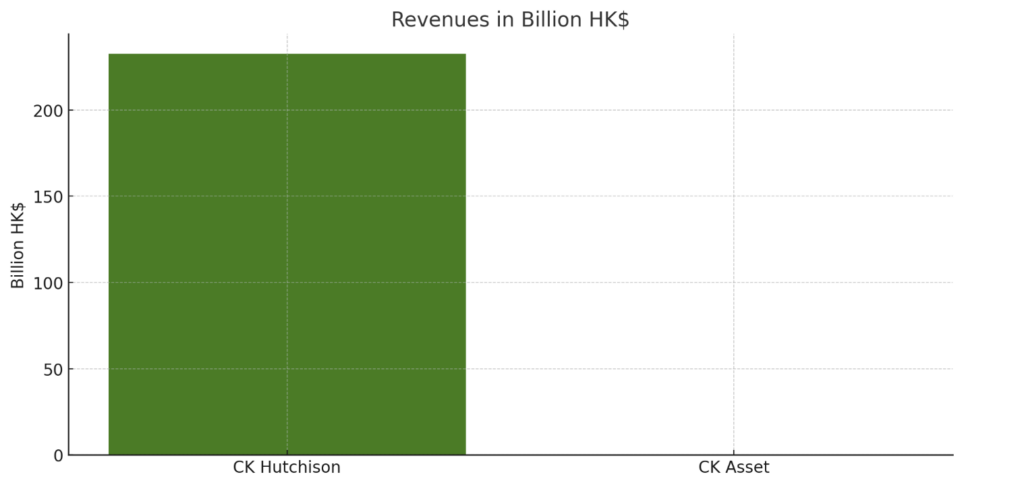

CK Hutchison, a global conglomerate with interests spanning ports, telecommunications, and retail, saw a 7 percent decline in earnings, dropping to HK$10.2 billion (US$1.31 billion). However, revenue increased by 4 percent to HK$232.6 billion, according to a filing with the Hong Kong stock exchange on Thursday.

CK Asset, Li’s property development vehicle, experienced a more pronounced decline, with earnings tumbling 16.7 percent to HK$8.6 billion. This decrease was attributed to diminished confidence in the market, affecting both residential and commercial property sales in Hong Kong.

Optimism Despite Challenges

Despite these setbacks, Victor Li Tzar-kuoi, chairman of both companies and Li Ka-shing’s eldest son, remains optimistic about Hong Kong‘s recovery potential. In a post-earnings call, he expressed confidence in the city’s ability to rebound quickly, citing historical trends that show rapid recoveries in market conditions.

“Our experience shows that when the Hong Kong market turns around, it can do so very swiftly,” Li stated. “I am not going to bet against Hong Kong’s ability to recover. History has proven that those who do have been wrong.”

Strategic Investments

In response to the challenges, the Li family’s companies have invested approximately US$1.5 billion in acquiring utilities and other businesses abroad, aiming to stabilize earnings with steady, recurring income from overseas assets. This strategic shift is part of CK Hutchison’s broader approach to managing earnings decline during uncertain times.

Global Economic Outlook

The economic outlook globally remains uncertain due to ongoing geopolitical tensions and trade disputes. Li acknowledges that the global business environment is being shaped by these factors, with varying growth momentum and monetary policies affecting different regions.

Stock Market Impact

On the stock market, CK Hutchison’s shares retreated by 1.1 percent to HK$40.85, while CK Asset’s shares gained 0.6 percent to HK$31.60. CK Asset reported that property transactions in Hong Kong peaked in April following the government’s removal of market curbs in February. However, high interest rates have continued to dampen market sentiment. Property sales fell by 44 percent to HK$4.63 billion compared to the previous year, with revenue primarily coming from specific projects in Hong Kong and mainland China.

Dividend Adjustments

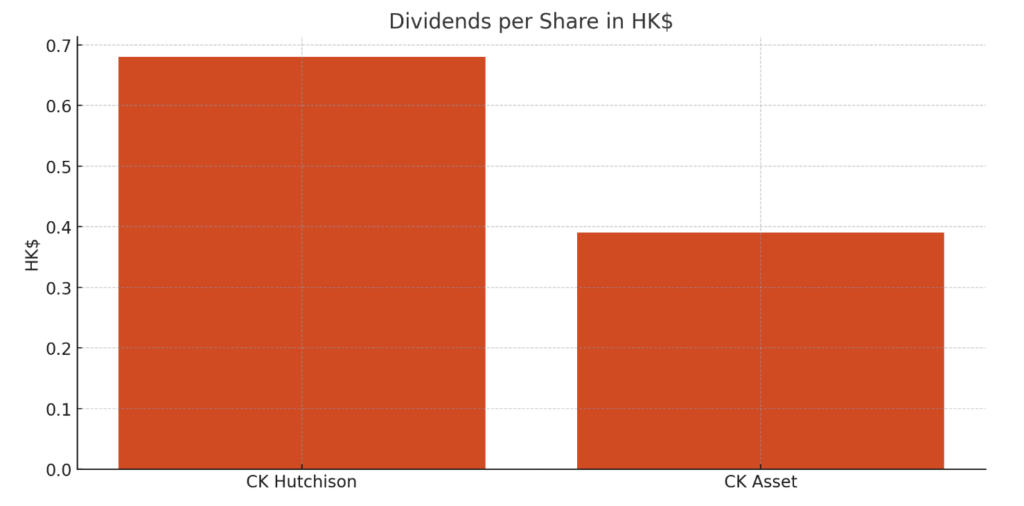

Both companies have announced plans to reduce interim dividends, with CK Hutchison lowering its payout to HK$0.68 per share from HK$0.756, and CK Asset cutting its dividend to HK$0.39 per share from HK$0.43.