Bridgewater’s Significant Reduction in Chinese Stock Holdings

Bridgewater Associates, the world’s largest hedge fund, has made a substantial move by significantly reducing its exposure to US-listed Chinese stocks. Over the past two years, the hedge fund, founded by billionaire Ray Dalio, has cut its stakes in mainland Chinese companies by approximately 80%. This shift comes as returns from these investments have lagged behind those in other global markets.

Exiting Major Chinese Companies

According to Bridgewater’s latest 13F filing in New York, the hedge fund has completely exited its positions in key Chinese companies, highlighting the focus on Bridgewater Chinese Stock Reduction. These include the social-media platform Weibo, video-streaming company Joyy, and solar-panel manufacturer Daqo New Energy. Furthermore, the hedge fund has notably reduced its holdings in other prominent Chinese companies, such as electric vehicle maker Li Auto, restaurant chain operator Yum China, and online travel service provider Trip.com, by as much as 45%. This strategic move clearly reflects Bridgewater’s reassessment of its investment focus.

Declining Interest in Chinese Equities

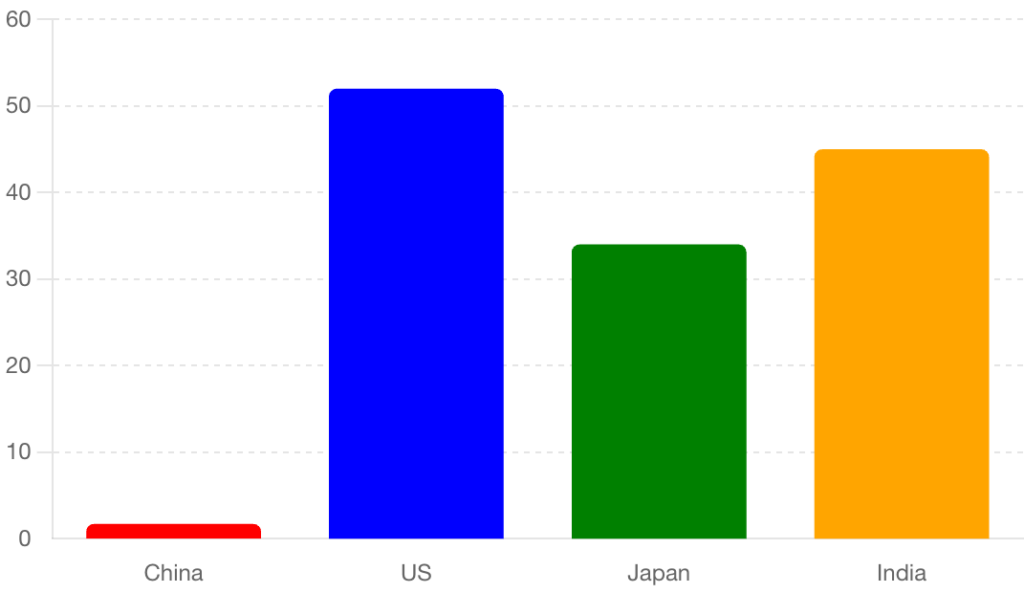

This significant reduction in Chinese stocks reflects a broader trend of declining interest in Chinese equities. While the MSCI China Index, a comprehensive measure of Chinese stocks, saw a modest increase of 1.7% over the past seven quarters, major indices in the US, Japan, and India surged between 34% and 52%, according to Bloomberg data. The underperformance of Chinese stocks can be attributed to several economic challenges, including slower GDP growth, a prolonged property market slump, and price deflation. Notably, in the second quarter, China’s GDP growth rate slowed to 4.7%, down from 5.3% in the previous quarter, further weakening investor confidence.

Bridgewater’s Current Portfolio

As of the latest filing, Bridgewater’s global stock portfolio, which includes 877 companies valued at $19.2 billion, now contains only 14 Chinese companies. The market value of these Chinese holdings decreased by 14.5% last quarter, shrinking to $266 million. Additionally, Bridgewater reduced its stakes in China-focused exchange-traded funds (ETFs), cutting its holdings in the iShares China Large-Cap ETF by 11% and the iShares MSCI China ETF by 10%. These reductions underscore Bridgewater’s cautious approach toward Chinese equities in the current economic climate.

Dalio’s Perspective on Chinese Assets

Despite these reductions, Ray Dalio, who stepped down from Bridgewater in 2022, still sees value in Chinese assets, which he considers “attractively priced.” Dalio emphasizes the importance of diversification, particularly as both China and the US face significant economic challenges. Therefore, while Bridgewater Chinese Stock Reduction has occurred, the potential for Chinese investments remains on Dalio’s radar.

Broader Trend Among Institutional Investors

Bridgewater’s retreat from Chinese stocks mirrors a broader trend among foreign institutional investors. Investments in China A-shares have sharply declined since their peak in 2021. This outflow of capital from Chinese stocks has continued into 2023, with net outflows totaling $200 million as of last week, according to Goldman Sachs. Moreover, other hedge funds are also following this trend. Fenghe Fund Management, co-founded by Alibaba Group’s chief technology officer, exited from several major Chinese companies, including TAL Education, Alibaba Group, and Yum China, in one of its most significant portfolio adjustments last quarter.

Conclusion

In summary, Bridgewater’s substantial reduction in its Chinese stock holdings highlights a broader market trend driven by underperformance and economic challenges in China. As the global economic landscape continues to evolve, Bridgewater’s strategy reflects the ongoing reassessment of investment opportunities in Chinese equities.